Rift to Revenue: Towards a Carbon-Competitive East Africa

Carbon Capture and Storage (CCS), once considered a peripheral strategy in global decarbonization, has regained prominence as a key mitigation pathway in the IPCC's AR6 scenario models. However, most of the current discourse is anchored in the Global North. East Africa, with its intersection of geothermal abundance, and carbon market emergence, offers an underexplored yet compelling environment for deploying carbon capture technologies. This article interrogates East Africa’s CCS potential through a multi-scalar lens, encompassing infrastructural feasibility, regulatory readiness, and the macroeconomic logic of carbon market participation.

Understanding How Carbon Capture Works

CCS functions by isolating carbon dioxide (CO₂) either directly from ambient air or from concentrated emission streams before the gas is released into the atmosphere. Once captured, CO₂ is conditioned for compression, transportation, and long-term storage within subsurface geological formations, ensuring permanent sequestration. CCS is categorized into three core methods:

Post-Combustion Capture: This approach uses chemical solvents to extract CO₂ from flue gases and is ideal for retrofitting existing cement and fertilizer plants.

Oxy-Fuel Combustion: In this process, fossil fuels are combusted in pure oxygen rather than ambient air. This yields a flue gas composed primarily of CO₂ and water vapor. By minimizing the presence of nitrogen, oxy-fuel combustion reduces the energy penalty associated with CO₂ purification, making it an efficient route for retrofits in high-emission sectors such as cement and steel production.

Direct Air Capture (DAC): DAC involves extracting CO₂ directly from atmospheric air using solid sorbents such as liquid alkaline solvents like potassium hydroxide. Once saturated, the sorbents are regenerated, releasing high-purity CO₂ for sequestration. Though more energy-intensive than point-source capture, DAC enables net-negative emissions and is location-flexible.

Rift Valley Carbon Storage Advantage

Geologically, the East African Rift System (EARS) offers the most promising carbon subsurface geologic sequestration potential on the planet. Spanning over 3,000 kilometres, its basalt formations are rich in reactive silicates that rapidly mineralize CO₂ into solid carbonate rock. This process ensures both stability and permanence within months of injection. A study by the Institute for Climate Change and Adaptation (ICCA) estimated a theoretical storage capacity of 100,000–250,000 Gt. The Kenyan and Ethiopian segments alone are estimated to offer upwards of 5 Gt in viable subsurface geologic sequestration, equivalent to centuries of current regional point-source CO₂ effluent streams. Moreover, brownfield integration scenarios at high-enthalpy geothermal power plants such as Olkaria and Menengai reduce the net cost of DAC and subsurface geologic sequestration below $35 per ton by exploiting existing reinjection of geochemically reactive formation fluids infrastructure. In parallel, offshore saline formations in Tanzania, notably Songo Songo and Mnazi Bay, hold between 500-800 million tons of capacity and are strategically located near major industrial corridors, creating a dual-front storage opportunity.

Emerging Proofs of Concept

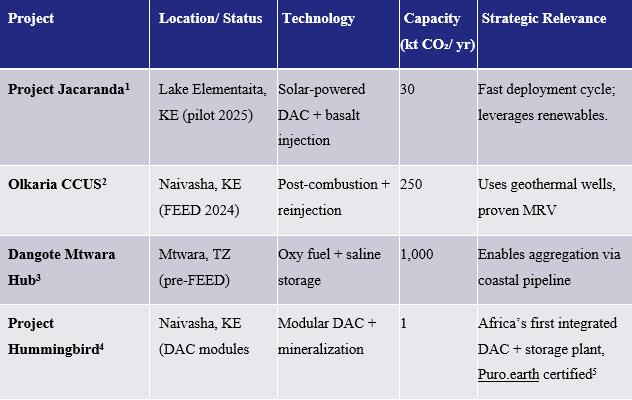

Several pilot initiatives are now crystallizing the technical and commercial viability of CCS in East Africa.

These projects are small relative to the region’s mitigation gap but illustrate three viable business models: premium DAC credits for corporates, brownfield retrofits with negative marginal abatement cost, and hard‑to‑abate industrial clusters financed through advance offtake agreements.

The Economics of Carbon Capture

Macroeconomic context

East Africa’s economy is projected to sustain annual GDP growth of 5‑6% through 2035, driven by aggressive expansion in cement manufacturing, fertiliser production, and geothermal energy. These sectors, while essential to economic development, are poised to double the regional CO₂ emissions to an estimated 200 Mt by 2040. In parallel, the bloc issues roughly 20% of global voluntary‑market credits, giving it an outsized voice in carbon finance relative to its footprint. CCS can square this circle by decarbonising hard‑to‑abate industries while exporting high‑quality removal credits and unlocking concessional capital for energy infrastructure.

Economic Viability and Cost Curves

The economics of carbon capture in East Africa are increasingly compelling. Point-source capture costs range from $60–90 per tonne in cement applications, while geothermal-integrated systems can reduce costs to $35–50 per tonne by leveraging existing thermal infrastructure. Although DAC currently costs around $400 per tonne, the price is expected to fall below $200 by 2030 with modular scaling and design iteration. Crucially, East Africa’s geology often permits collocated capture and storage, bypassing the need for expensive CO₂ transport infrastructure. When pipelines are necessary, rights-of-way in East Africa are estimated at 40% lower than in Europe due to reduced population density, further enhancing project economics.

Revenue Potential

On the revenue side, CCS projects in East Africa have the potential to command premium pricing in global carbon markets. For instance, credits for permanent CO₂ removals via mineralization trade at $180–250 per tonne on leading offset platforms, 3–5 times higher than agroforestry-based removals. Even with scaled deployment, durable removal credits are expected to retain floor prices above $100 per tonne, driven by corporate net-zero demand and regulatory shifts toward quality-differentiated markets.

At a conservative $50 per tonne credit valuation, East Africa’s CCS ecosystem could generate $1–2 billion in annualized carbon revenue by the mid-2030s. This market pull has the potential to catalyse upwards of $10 billion in cumulative capital inflows for CO₂ pipelines, injection networks, DAC arrays, and associated grid reinforcements. The scale and structure of this opportunity demand proactive policy architecture, targeted concessional finance, and robust MRV standards to convert theoretical returns into executable projects.

Carbon Markets and Policy Frameworks

East Africa’s emergence as a CCS leader hinges on coherent, forward-thinking policy.

Kenya’s 2024 Climate Change (Carbon Markets) Regulations offer a model, mandating third-party verification and creating fast‑track approval for non‑land‑based projects, which is critical for DAC. Tanzania is finalising CCUS guidelines within its 2024 Oil & Gas Transition Plan, enabling storage licensing and cross‑border pipelines.

On a regional scale, the East African Community (EAC) Energy & Environment Committee is drafting a Protocol on Transboundary CO₂ Transport, leveraging OGCI “hub” templates to harmonise safety and liability standards. The Eastern Africa Alliance on Carbon Markets and Climate Finance is working to establish robust carbon market mechanisms aligned with Article 6 of the Paris Agreement. These mechanisms aim to facilitate the trading of carbon credits by providing financial incentives for emission reduction projects.

Complementing this is the Africa Carbon Markets Initiative (ACMI), which seeks to expand the continent's participation in voluntary carbon markets, aiming to produce 300 million new carbon credits annually by 2030. ACMI’s proposition to introduce a $20/t floor price, paired with rising premiums for engineered removals, further aims to stabilize credit valuations and protect against market dilution from lower-quality offsets.

Infrastructure Gaps and Grid Constraints

East Africa faces two major mutually reinforcing bottlenecks that could stall early CCS scale‑up. First, the region has no dedicated CO₂ pipelines and only a nascent fleet of pressurised road tankers, driving transport costs to 2-3 times those seen in mature hubs and limiting capture projects to point‑source storage pairings. Second, weak grid interconnections and uneven power‑quality standards constrain the 1–3 MW continuous loads typical of modular DAC skids.

A Pathway Forward

A phased strategy is essential. In the short-term, developers should accelerate deployment of modular microgrids that pair geothermal wells with hydro, solar photovoltaics and battery storage. These islanded units reliably and affordably supply the 2‑3 MW baseload required at competitive tariffs by pilot DAC plants without relying on fragile national grids. Once pilots prove to be economical, utilities, grid operators, and private investors should co‑fund a backbone CO₂ pipeline connecting major emitters to certified storage sites, and reinforced transmission loops tying microgrids into the broader network.

Outlook: An Inflection Point Within Reach

East Africa is positioned at a pivotal crossroads. With the convergence of regulatory reform, geological suitability, and emerging market interest, the region has the tools to redefine its role in global carbon governance. Rather than supplying offset credits to external buyers, it can architect a high-integrity carbon economy rooted in domestic value creation and industrial decarbonization.

Realizing this potential requires coordinated action across regulatory, technical and financial domains. Governments must set the tone by providing regulatory clarity and stable market frameworks. With this foundation in place, developers are empowered to deploy technically sound pilot projects. Consequently, the success of these pilots generates the operational credibility investors need, allowing them to commit capital through targeted financial instruments designed to absorb short-term risk and reward long term resilience.

Inaction risks entrenching legacy emissions infrastructure and surrendering strategic ground to regions that move faster. The alternative is a future where East Africa defines the global benchmark for engineered carbon removals—rooted in domestic value creation. while building a new engine for resilient economic growth.